Florida Payroll Tax Deduction Guide 2018

The Internal Revenue Service (IRS) has released Publication 15 (Circular E), Employer’s Tax Guide, for use in 2018. This publication:. Details employers’ federal tax responsibilities;. Explains the federal requirements for withholding, depositing, reporting, paying, and correcting employment taxes;. Lists the forms employers must give to their employees, those that employees must give to the employer, and those that the employer must send to the IRS and Social Security Administration; and.

Features the tax tables to calculate the taxes to withhold from each employee. Publication Highlights Highlights of the 2018 publication include the following:. Social Security and Medicare Tax for 2018. The Social Security tax rate is 6.2% each for the employee and employer. The Social Security wage base limit is $128,400. The Medicare tax rate is 1.45% each for the employee and employer. There is no wage base limit for the Medicare tax.

Jump to Learn More About Florida Withholding - But there's no escaping federal tax withholding. Since released updated tax withholding guidelines and taxpayers should have seen changes to their paychecks, to reflect the new tax plan, starting in February 2018. When you look at your Florida pay stub you'll see.

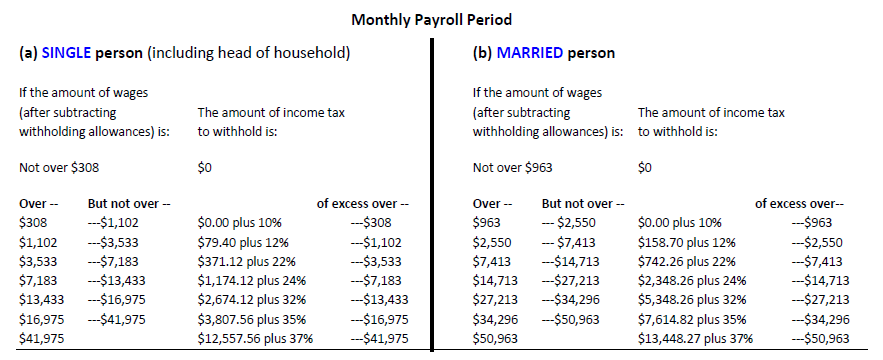

2018 Withholding Tables. The publication includes the 2018 Percentage Method Tables and Wage Bracket Tables for Income Tax Withholding. Withholding Allowance. The 2018 amount for one withholding allowance on an annual basis is $4,150. To access the 2018 IRS Publication 15. This entry was posted in and tagged,. Bookmark the. Post navigation.

The major changes made to this guide since the last edition are outlined. This guide reflects some income tax changes recently announced which, if enacted as proposed, would be effective January 1, 2018. At the time of publishing, some of these proposed changes were not law. We recommend that you use the new payroll deductions tables in this guide for withholding starting with the first payroll in January 2018. The federal income tax thresholds have been indexed for 2018. The federal Canada employment credit has been indexed to $1,195 for 2018. The federal basic personal amount, the spouse or common-law partner amount and the amount for an eligible dependant have been indexed to $11,809 for 2018.

There are no changes to the Ontario income tax rates for 2018. The provincial income thresholds, personal amounts, surtax thresholds and tax reduction amounts have been indexed for 2018. Who should use this guide? This guide is intended for the employer and the payer. It contains tables for federal and provincial tax deductions, CPP contributions and EI premiums. It will help you determine the payroll deductions for your employees or pensioners. For more information on deducting, remitting, and reporting payroll deductions, see the following employers' guides:.

Manual service kijang super. T4001, Employers' Guide – Payroll Deductions and Remittances. T4130, Employers' Guide – Taxable Benefits and Allowances. RC4110, Employee or Self-employed?. RC4120, Employers' Guide – Filing the T4 Slip and Summary.

RC4157, Deducting Income Tax on Pension and Other Income, and Filing the T4A Slip and Summary These guides are available on our website at canada.ca/taxes. Which provincial or territorial tax table should you use? Before you decide which tax table to use, you have to determine your employee's province or territory of employment. This depends on whether or not you require the employee to report for work at your place of business.

If the employee reports for work at your place of business, the province or territory of employment is considered to be the province or territory where your business is located. To withhold payroll deductions, use the tax table for that province or territory of employment. If you do not require the employee to report for work at your place of business, the province or territory of employment is the province or territory in which your business is located and from which you pay your employee's salary. For more information and examples, see Chapter 1, 'General Information' in Guide T4001, Employers' Guide – Payroll Deductions and Remittances. For 2018, Ontario's tax reduction amounts are revised: Basic personal amount $239 Amount for each dependant under age 18 $442 Amount for each dependant with a disability that the employee or pensioner has claimed on Form TD1ON $442 The reduction is equal to twice the individual's personal amounts minus the provincial tax payable before reduction. The reduction cannot be more than the provincial tax payable before reduction. The reduction is nil when the provincial tax payable before reduction is more than twice the personal amounts.

Because of the way the reduction for dependants with disabilities is determined, we include only the basic personal amount in the provincial tax tables. Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions If your employees want you to adjust their tax deductions to allow for commission expenses, they have to complete Form TD1X, Statement of Commission Income and Expenses for Payroll Tax Deductions.

You deduct tax from your employees' commission pay using the 'Total claim amount' on their TD1 forms in the following situations:. if your employees do not complete a Form TD1X or.

if they tell you in writing that they want to cancel a previously completed Form TD1X. Tax deductions tables If you are using the income tax tables in this guide to determine your employees' and pensioners' total tax deductions, you have to look up the amounts in the federal tax table and the provincial tax table. To determine the total tax you deduct for the pay period, you must add the federal and provincial tax amounts. Even if the period of employment for which you pay a salary is less than a full pay period, you must continue to use the tax deductions table that corresponds to your regular pay period. You are an employer in Ontario. Sara, your employee, earns $615 a week in 2018. She has a federal claim code 1 and a provincial claim code 1.

To determine Sara’s federal tax deductions, you look at the weekly federal tax deductions table and find the range for her weekly salary, which is 609-617. The federal tax deductions for $615 weekly under claim code 1 is $48.85. To determine Sara's provincial tax deductions, you use the weekly provincial tax deductions table. In the Ontario tax deductions table, the provincial tax deduction for $615 weekly under claim code 1 is $24.85. Sara's total tax deduction is $73.70 ($48.85 + $24.85).

This amount of taxes will be included in your remittance to us. Deducting tax from income not subject to CPP contributions or EI premiums We have built the tax credits for CPP contributions and EI premiums into the federal and provincial tax deductions tables in this guide. However, certain types of income, such as pension income, are not subject to CPP contributions and EI premiums. As a result, you will have to adjust the amount of federal and provincial income tax you are deducting. To determine the amount of tax to deduct from income not subject to CPP contributions or EI premiums, use the Payroll Deductions Online Calculator, available at canada.ca/pdoc.

On the 'Salary calculation' and/or on the 'Commission calculation' screen, go to Step 3 and select the 'CPP exempt' and/or 'EI exempt' option before clicking on the 'Calculate' button. Step-by-step calculation of tax deductions You can use the following step-by-step calculations to calculate the tax deductions for any employee or pensioner who earns more than the maximum amounts included in the tax deductions tables.

Florida Payroll Tax Calculator 2018

The example shows you how to determine the amount of tax to deduct from all income. However, if you design your own payroll program or spreadsheets to calculate tax deductions, do not use either of these calculations. Instead, see Guide T4127, Payroll Deductions Formulas. Calculate annual taxable income Description Sub-amounts Amounts (1) Gross remuneration for the pay period (weekly) $1,100.00 (2) Minus. the other amounts authorized by a tax services office 0.00. the RRSP contributions. 80.00 − (80.00).

2018 Payroll Deductions Table

This amount has to be deducted at source. Note If you have an employee you paid by commission, subtract the total expenses reported on Form TD1X from the gross remuneration reported on Form TD1X if applicable. (3) Net remuneration for the pay period $1,020.00 (4) Annual net income ($1,020 × 52 weeks) $53,040.00 (5) Minus the annual deduction for living in a prescribed zone, reported on the federal Form TD1 n/a (6) Annual taxable income $53,040.00. Calculate federal tax Description Sub-amounts Amounts (7) Multiply the amount on line 6 by the federal tax rate based on Chart 1.